-

Why Leeway Planning?

Leeway Planning's guiding philosophy is “Process Over Outcomes” -- in other words, let's avoid “putting the cart before the horse.”

While it's important to have clarity on desired outcomes, prioritizing effective systems and processes allow the opportunity for favorable outcomes to naturally and sustainably produce themselves.

On the other hand, dialing in on a preferred outcome without understanding which activities to prioritize can result in more frequent and/or more painful headaches.

In short, focusing on the what without considering the how probably won't lead the way to long-term success.

-

How do clients pay?

Using the easy-access AdvicePay portal, clients enter their own financial information, approve payments, and make any account changes throughout the course of an agreement.

Payments are made on a quarterly basis and are processed via ACH, debit card, or credit card (MasterCard, Visa, American Express, Discover).

The implementation of recommendations, including investment management, may lead to additional fees. If recommendations are implemented with the help of Cody L. Ward, such costs will be transparent.

Each office of The Lincoln Investment Companies has its own fee schedule. Therefore, the cost for similar services by another office may be higher or lower than the fee schedule shown here. Fees may also vary with complexity of the case or the scope of the services provided. If you choose to implement your financial plan through us, the financial professional will act as agent for the broker-dealer, Lincoln Investment and/or agent for any insurance company with whom the financial professional may affiliate. Security recommendations will be limited to products offered by the broker-dealer. Although you always have the ability to purchase security products through other brokers or dealers, the fee schedule for our services has been structured with the understanding that our clients will implement financial product recommendation through our firm.

-

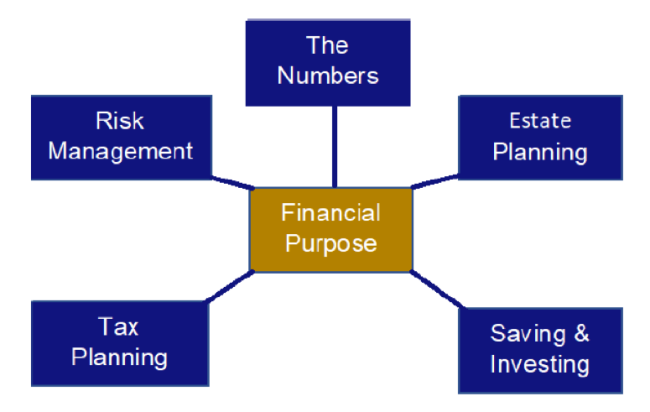

What are the key areas of your financial plan?

There are 6 key areas of your financial plan:

- Your numbers: The quantitative data organized in a way that helps you understand your financial circumstances.

- Estate Planning: The strategies that allow you to know what happens with your finances if/when you aren't able to decide for yourself.

- Risk Management: How you address the risks that pose the greatest threats to your financial success.

- Saving & Investing: The strategies that help you grow and protect assets that have been earmarked for certain goals

- Tax Planning: Your approach to paying a tax liability that isn't more than it should be.

- Financial Purpose: The philosophies that fuel the strategies in each key area

-

What is “financial planning”?

- Financial planning is an ongoing process. Why? The information that is relied on for making recommendations and course corrections is constantly changing, which makes one-time planning events nothing more than fleeting sandcastles.

- Financial planning is about creating and holding the space to understand the questions that come before personal finance decisions.

-

Who is a CERTIFIED FINANCIAL PLANNER™ Professional?

Most people think all financial planners are “certified,” but this isn’t true. Anyone can use the title “financial planner.” Only those who have fulfilled the certification and renewal requirements of CFP Board can display the CFP® certification trademarks which represent a high level of competency, ethics and professionalism. And because they are held to a fiduciary standard of care, a CFP® professional is required to act in your best interest.

Source: CFP Board of Standards, Inc.; Consumer Guide to Financial Planning

-

How does the CFP Board’s Code of Ethics benefit clients?

When it comes to ethics and professional responsibility, CFP® professionals are held to the highest of standards. They are obliged to uphold the principles of integrity, objectivity, competence, fairness, confidentiality, professionalism and diligence as outlined in CFP Board’s Code of Ethics. The Rules of Conduct require CFP® professionals to put your interests ahead of their own at all times and to provide their financial planning services as a “fiduciary”—acting in the best interest of their financial planning clients. CFP® professionals are subject to CFP Board sanctions if they violate these standards.

Source: CFP Board of Standards, Inc.; Consumer Guide to Financial Planning

-

Why do clients need to provide so much personal information?

Planning recommendations are only as good as the understanding of your circumstances. An understanding of your circumstances is not possible without knowing the relevant quantitative and qualitative information. The privacy and security of your information is of the utmost importance before, during, and after your work with Leeway Planning.

-

What if your question wasn’t covered?

Please “Get In Touch” if your question wasn’t answered.